📚 Table of Contents

- ✅ Understanding the Shift: Why Asset Tokenization Matters

- ✅ What to Look For in an Asset Tokenization Platform

- ✅ Polymath: The Security Token Pioneer

- ✅ Securitize: The End-to-End Digital Securities Leader

- ✅ Harbor: Streamlining Real Estate and Private Equity

- ✅ Tokeny: The Institutional-Grade Tokenization Engine

- ✅ tZERO: Bridging Traditional Markets with Blockchain

- ✅ Swarm: Democratizing Access to Alternative Assets

- ✅ Coinbase Asset Hub: Simplicity from a Crypto Giant

- ✅ Conclusion

Understanding the Shift: Why Asset Tokenization Matters

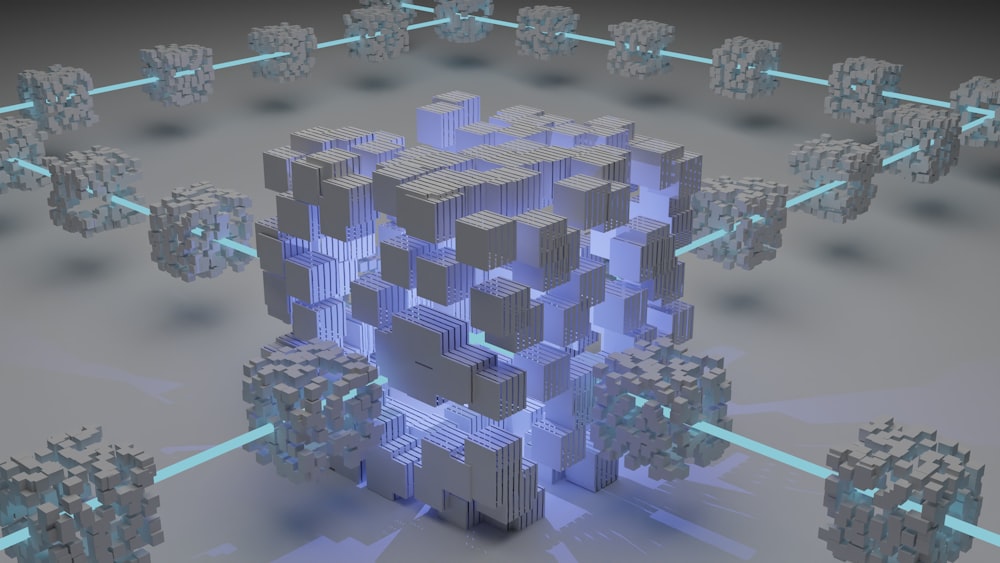

Imagine a world where owning a piece of a rare painting, a prime commercial real estate property, or a startup company is as simple and liquid as trading a stock on an exchange. This is the revolutionary promise of asset tokenization, a process that converts rights to a physical or intangible asset into a digital token on a blockchain. But to truly harness this power, one must first understand the tools and platforms that make it possible. The journey into this new financial frontier begins with education, and the key question for many innovators and investors is: where are the best places to learn asset tokenization? The answer lies not just in theoretical courses, but in engaging with the very platforms that are building the infrastructure for this new economy. Learning asset tokenization effectively requires a hands-on approach, where theoretical knowledge meets the practical, evolving landscape of blockchain-based finance. This shift is dismantling traditional barriers to investment, offering unprecedented levels of liquidity, fractional ownership, and operational transparency, making it one of the most significant financial innovations of our time.

What to Look For in an Asset Tokenization Platform

When embarking on the journey of learning asset tokenization, the platform you choose to study and interact with is crucial. A comprehensive platform for learning asset tokenization should offer more than just whitepapers; it should provide a holistic ecosystem. Key features to evaluate include the robustness of the underlying blockchain technology, whether it’s Ethereum, Polkadot, or a private ledger. Compliance is non-negotiable; the platform must have built-in mechanisms for ensuring adherence to securities laws in various jurisdictions, such as KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols. The user experience for both the token issuer and the end-investor is a telling sign of the platform’s maturity. Furthermore, a platform’s educational resources, documentation clarity, developer community, and case studies are invaluable for a learner. A platform that offers sandbox environments or testnets for experimentation is a goldmine for practical understanding, allowing you to tokenize dummy assets and understand the workflow from issuance to secondary trading.

Polymath: The Security Token Pioneer

Polymath has been a cornerstone in the security token space since its inception, making it an essential platform for anyone learning asset tokenization. It was built with a singular focus: to facilitate the creation and management of security tokens in a compliant manner. Polymath’s core strength lies in its ST-20 standard, a token standard on the Ethereum blockchain specifically designed to integrate regulatory requirements directly into the token’s smart contract. This means that transfers can be automatically restricted to whitelisted addresses that have passed KYC/AML checks. For a learner, exploring Polymath provides a deep dive into the legal and technical complexities of security tokens. Their Polymesh blockchain, a purpose-built blockchain for regulated assets, takes this a step further, addressing specific challenges like governance, identity, and confidentiality. By studying Polymath’s documentation and its transition from Ethereum to a dedicated chain, one gains insight into the evolving needs of the tokenization industry and the importance of a specialized infrastructure.

Securitize: The End-to-End Digital Securities Leader

Securitize operates as a full-stack digital securities platform, offering a complete suite of services from token issuance to investor management and secondary trading liquidity. This comprehensive approach makes it a perfect case study for learning asset tokenization in a real-world context. Their DS Protocol, which powers Securitize-powered digital securities, is a key differentiator. It enables automated compliance, dividend distributions, and voting capabilities directly on the blockchain. For an educational pursuit, Securitize’s platform demonstrates how to manage the entire lifecycle of a tokenized asset. Their “Securitize iD” is a reusable digital identity that streamlines the investor onboarding process, a critical component for scaling tokenized securities. By analyzing how Securitize partners with broker-dealers, transfer agents, and alternative trading systems (ATS), a learner can understand the entire capital markets value chain and how blockchain is being integrated into existing financial frameworks rather than just displacing them.

Harbor: Streamlining Real Estate and Private Equity

Harbor has carved out a significant niche by focusing on tokenizing traditionally illiquid assets like real estate and private equity funds. Their R-Token standard is a compliance protocol that works on top of existing ERC-20 tokens, pausing transactions until they are verified by a designated “Compliance Officer” node on the network. This model is particularly instructive for those learning asset tokenization for specific asset classes. Harbor’s platform showcases how to handle the unique challenges of real estate, such as property valuations, income distributions, and regulatory filings at the state and federal level. Studying Harbor’s approach reveals the importance of building for specific use cases. Their workflow, which includes onboarding issuers, structuring the offering, and managing the tokenized asset post-issuance, provides a clear, end-to-end blueprint for how blockchain can bring efficiency and accessibility to the world of private investments.

Tokeny: The Institutional-Grade Tokenization Engine

Tokeny provides an institutional-grade infrastructure that empowers financial institutions to tokenize and manage their assets throughout their entire lifecycle. A key feature for anyone learning asset tokenization through Tokeny is their T-REX protocol (Token for Regulated EXchanges). This open standard defines the roles and actions of various actors in a security token’s life, such as investors, issuers, and compliance officers, embedding permissioning and control at the token level. Tokeny’s platform is a masterclass in building for enterprise clients. It emphasizes security, scalability, and integration with traditional systems. By examining Tokeny, a learner understands the critical need for robust identity verification (they integrate with various KYC providers), the mechanics of dividend payments in digital form, and the tools needed for corporate actions like share transfers or capital increases on the blockchain. Their focus on empowering existing financial players rather than replacing them offers a pragmatic perspective on the industry’s evolution.

tZERO: Bridging Traditional Markets with Blockchain

tZERO is perhaps one of the most well-known names in the space, partly due to its backing by Overstock.com. It represents a massive real-world experiment in creating a fully regulated ecosystem for digital securities. tZERO is not just a tokenization platform; it’s also an alternative trading system (ATS) licensed by the SEC. This dual role makes it an invaluable resource for learning asset tokenization, as it demonstrates the entire process from issuance to secondary market trading. Studying tZERO’s journey, including its own token offering and the listing of other assets like the Aspen Coin (a tokenized real estate investment), provides practical insights into the regulatory hurdles and market dynamics of security tokens. Their technology stack, which prioritizes speed and transparency, and their focus on creating a liquid market for tokenized assets, offers a comprehensive view of what it takes to build a new financial market from the ground up.

Swarm: Democratizing Access to Alternative Assets

Swarm takes a slightly different approach, positioning itself as a platform that uses blockchain technology to democratize access to alternative assets. Their focus is on creating a borderless and open market for assets that are typically hard to access for the average investor. For those learning asset tokenization, Swarm is an excellent example of a platform built with a clear philosophical and economic mission. They have tokenized a diverse range of assets, from crypto indices to real estate and even fine art. This diversity in use cases is a fantastic learning tool. By exploring Swarm’s model, one can understand the technical and legal frameworks required to represent such a wide array of assets on a blockchain. Their use of the Stellar blockchain also introduces learners to an alternative to Ethereum, highlighting the trade-offs in transaction speed, cost, and consensus mechanisms when selecting a foundation for a tokenization project.

Coinbase Asset Hub: Simplicity from a Crypto Giant

While newer to the specific domain of security tokens, Coinbase’s entry with its Asset Hub cannot be ignored. Leveraging its massive user base and regulatory standing, Coinbase aims to simplify the process of issuing digital assets. For a learner, the value in studying Coinbase Asset Hub lies in understanding how a major exchange is vertically integrating the tokenization process. The platform is designed to handle the technical and compliance complexities, allowing issuers to focus on their asset and investors. This model highlights a key trend in the industry: the consolidation of services under large, trusted brands. Learning about asset tokenization through the lens of Coinbase provides insight into the future of the market, where user experience and regulatory clarity are paramount. It demonstrates how the infrastructure is becoming more accessible, potentially leading to a surge in tokenized assets as the barriers to entry continue to fall.

Conclusion

The landscape for learning asset tokenization is rich and varied, with each platform offering a unique perspective on how to bridge the physical and digital worlds of finance. From the specialized security token focus of Polymath and Securitize to the use-case specific approaches of Harbor and Swarm, and the institutional and exchange-driven models of Tokeny, tZERO, and Coinbase, there is a wealth of knowledge to be gained. The most effective learning path involves not just reading about these platforms but actively engaging with their documentation, exploring their test networks, and analyzing their real-world tokenization cases. As this technology continues to mature, the platforms that prioritize compliance, user experience, and real-world utility will lead the charge in reshaping global finance, making now the perfect time to dive in and master the art and science of asset tokenization.

💡 Click here for new business ideas

Leave a Reply