As businesses race toward digital transformation, a critical question emerges: will remote bookkeeping services stand the test of time, or will AI automation completely reshape financial management by 2030? The battle between human expertise and machine efficiency is heating up, with both sides offering compelling advantages. Let’s explore which solution is poised to dominate the future of bookkeeping.

📚 Table of Contents

The Rise of Remote Bookkeeping

Remote bookkeeping has gained immense popularity, offering businesses access to skilled professionals without geographical constraints. This model provides flexibility, personalized service, and human oversight—qualities that many companies still value over fully automated solutions. However, as AI automation advances, the role of remote bookkeepers may shift toward advisory services rather than transactional tasks.

AI Automation in Bookkeeping

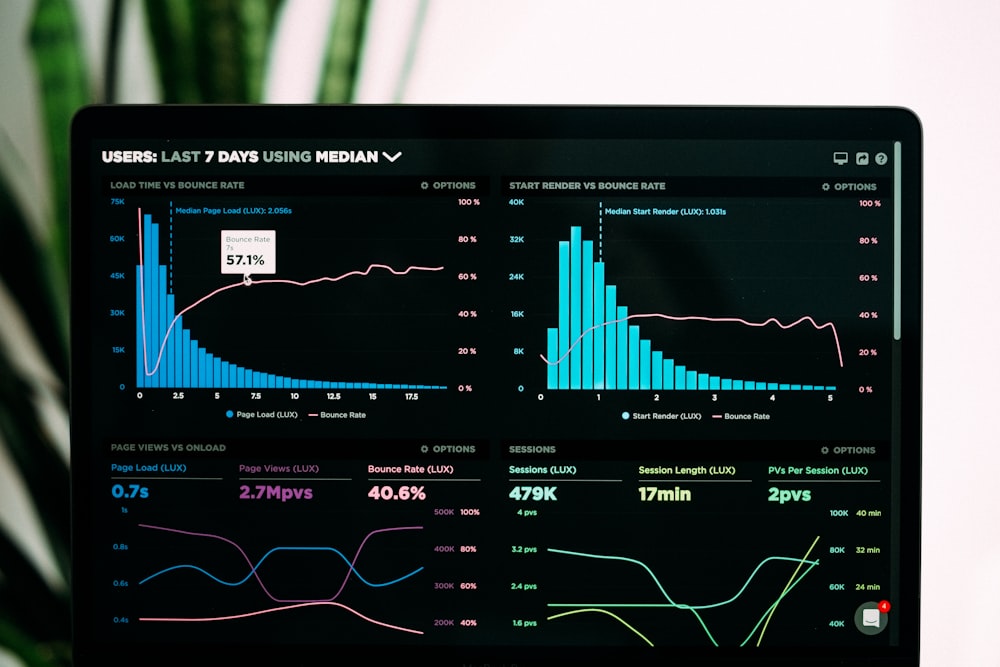

AI-powered bookkeeping tools are transforming financial workflows with real-time data processing, error detection, and predictive analytics. Machine learning algorithms can categorize expenses, reconcile accounts, and generate reports faster than any human. While AI automation excels in efficiency, some businesses remain hesitant about fully trusting algorithms with sensitive financial decisions.

Key Differences Between Remote and AI Bookkeeping

The fundamental distinction lies in human judgment versus algorithmic precision. Remote bookkeepers bring contextual understanding and adaptability, while AI offers unparalleled speed and scalability. Cost structures also differ significantly—AI solutions typically operate on subscription models, whereas remote services may charge hourly or retainers. Compliance handling presents another divergence, as human professionals navigate gray areas better than rigid AI systems.

Future Trends Shaping the Industry

By 2030, we’ll likely see a hybrid approach dominate, combining AI automation for routine tasks with human experts for strategic oversight. Cloud accounting platforms are already integrating AI assistants that work alongside human bookkeepers. The surviving professionals will be those who embrace AI tools to enhance their services rather than compete against them.

Conclusion

Rather than a winner-takes-all scenario, the future of bookkeeping will probably feature AI automation handling repetitive tasks while remote professionals focus on analysis, advisory, and exception management. Businesses that strategically blend both approaches will gain the greatest competitive advantage in financial management by 2030.

Leave a Reply