📚 Table of Contents

- ✅ What Exactly is Asset Tokenization? Demystifying the Digital Transformation

- ✅ How Asset Tokenization Works: The Technical Backbone

- ✅ The Unmatched Benefits of Asset Tokenization: Unlocking New Value

- ✅ Navigating the Risks and Challenges of Asset Tokenization

- ✅ Asset Tokenization in Action: Real-World Examples Across Industries

- ✅ Is Asset Tokenization Right for Your Assets? A Self-Assessment Guide

- ✅ Conclusion

Imagine a world where owning a piece of a rare Renaissance painting, a prime commercial real estate property in Manhattan, or a vintage sports car is as simple and liquid as trading a stock. This is no longer a futuristic fantasy but a tangible reality being built today through the power of asset tokenization. This revolutionary process is fundamentally reshaping how we perceive, own, and transfer value, breaking down barriers that have existed for centuries. But with such transformative potential comes a critical question: could this digital financial evolution be the right strategic move for you and your assets?

What Exactly is Asset Tokenization? Demystifying the Digital Transformation

At its core, asset tokenization is the process of converting the rights to a physical or intangible asset into a digital token on a blockchain. Think of it as creating a digital certificate of ownership that is secure, transparent, and easily transferable. The asset itself—be it a building, a company’s stock, or a piece of fine art—is legally placed into a custodial trust or a special purpose vehicle (SPV). This entity then issues a number of digital tokens that represent fractional ownership of that underlying asset. Each token is a smart contract, a self-executing piece of code on a distributed ledger, which encodes the rights and obligations of the holder. This is a significant leap beyond simple digitization; it’s about creating a programmable, interoperable, and universally accessible representation of value. The scope of what can be tokenized is vast and growing, encompassing real estate, equities, debt, commodities like gold and oil, intellectual property, and even collectibles. This process effectively democratizes access to investment opportunities that were previously the exclusive domain of the ultra-wealthy or institutional investors.

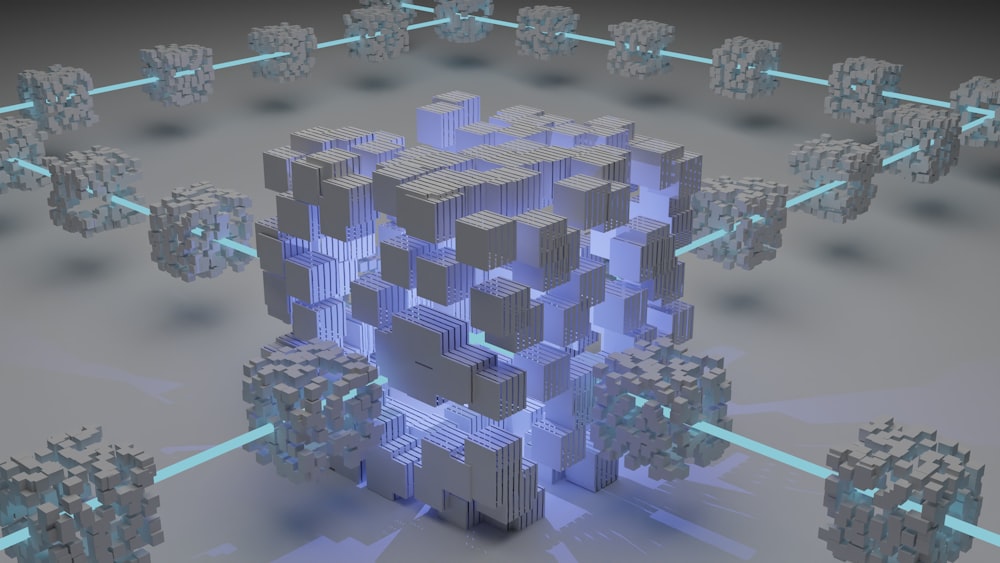

How Asset Tokenization Works: The Technical Backbone

The journey of asset tokenization is a multi-step process that blends legal frameworks with cutting-edge technology. It begins with the careful selection and due diligence of the asset to be tokenized. This involves a thorough legal and financial audit to ensure clear title, valuation, and the absence of any encumbrances. Once vetted, the asset is legally transferred to a custodian or a dedicated legal entity, which holds it for the benefit of the token holders. This step is crucial for establishing the legal link between the digital token and the real-world value it represents. Next comes the token creation phase. Developers write and deploy a smart contract on a chosen blockchain, such as Ethereum, Solana, or a private, permissioned ledger. This smart contract defines the entire lifecycle of the token: its total supply, ownership rules, how dividends or rental income will be distributed, and the conditions under which tokens can be transferred. For example, a token for a commercial property might be programmed to automatically distribute rental income to all token holders on a pro-rata basis every month, eliminating administrative overhead. Finally, these tokens are issued to investors, who can then trade them on secondary markets or digital asset exchanges, providing the liquidity that is so often missing from traditional illiquid asset classes.

The Unmatched Benefits of Asset Tokenization: Unlocking New Value

The advantages of embracing asset tokenization are profound and multifaceted, offering a compelling value proposition for both asset owners and investors. The most celebrated benefit is enhanced liquidity. By fractionalizing a high-value asset, tokenization opens the door to a much larger pool of potential investors. Instead of finding one buyer with millions of dollars, you can find thousands of buyers with smaller amounts of capital. This transforms illiquid assets like real estate and fine art into partially liquid investments. Secondly, it dramatically increases accessibility and democratizes investing</strong. A young professional in Brazil can now own a fractional stake in a Silicon Valley startup or a Tokyo office building, opportunities that were geographically and financially out of reach before. Thirdly, the process brings unparalleled transparency and security. Every transaction involving the token is recorded on an immutable blockchain, providing a clear and auditable trail of ownership. Smart contracts automate complex processes, reducing human error and the potential for fraud. Furthermore, tokenization can lead to significant cost reduction by cutting out many traditional intermediaries like brokers, transfer agents, and escrow services, thereby streamlining operations and settlement times from days to mere minutes.

Navigating the Risks and Challenges of Asset Tokenization

Despite its immense potential, the world of asset tokenization is not without its hurdles and risks that must be carefully considered. The most significant challenge remains the regulatory uncertainty. Governments and financial watchdogs around the world are still grappling with how to classify and regulate digital tokens. A token representing real estate could be considered a security in one jurisdiction and a simple utility token in another, leading to a complex web of compliance requirements. Secondly, the technological risk associated with the underlying blockchain and smart contracts is real. While blockchains are inherently secure, they are not impervious. Smart contracts can contain bugs or vulnerabilities that could be exploited by malicious actors, potentially leading to the loss of funds. Thirdly, there is the issue of market maturity and adoption. While growing rapidly, the ecosystem of exchanges, custodians, and service providers specializing in tokenized assets is still in its early stages compared to traditional financial markets. This can sometimes lead to lower trading volumes and price discovery challenges. Finally, the legal enforceability of token ownership in some jurisdictions is still being tested in courts, creating a layer of legal ambiguity that early adopters must navigate.

Asset Tokenization in Action: Real-World Examples Across Industries

To truly grasp the impact of asset tokenization, it’s helpful to examine its practical applications. In real estate, a landmark example is the tokenization of the St. Regis Aspen Resort in Colorado. The ownership group fractionalized the luxury hotel into digital tokens, allowing investors to buy shares for as little as a few thousand dollars, providing them with a stake in the property’s income and appreciation. In the art world, platforms like Maecenas allow users to purchase fractional ownership in masterpieces by artists like Andy Warhol. This not only provides liquidity to art owners but also allows art enthusiasts to build a diversified portfolio of blue-chip art. The venture capital and private equity space is also being disrupted. Startups are now issuing tokenized shares to raise capital from a global investor base, bypassing traditional and often restrictive fundraising channels. Even commodities are being transformed; companies are tokenizing barrels of oil or physical gold bars stored in secure vaults, making it easier for individuals to invest in these tangible assets without the logistical nightmare of physical delivery and storage.

Is Asset Tokenization Right for Your Assets? A Self-Assessment Guide

Determining whether asset tokenization aligns with your goals requires a honest self-assessment. This innovative approach is particularly well-suited for you if your primary assets are high in value and notoriously illiquid. If you own commercial real estate, a private company, or a valuable collection that is difficult to sell quickly without a significant discount, tokenization can unlock that trapped capital. It is also a powerful tool if your objective is to democratize ownership and attract a global, retail investor base, rather than relying on a small circle of wealthy individuals or institutions. Furthermore, if you are operating in a forward-thinking industry and are comfortable with being an early adopter of emerging technologies, the pioneering nature of tokenization may be a perfect fit. Conversely, tokenization might not be the ideal path if your asset is of low value, as the legal and technical setup costs may not be justified. It is also less suitable if you require immediate, full liquidation of the asset, as the secondary markets are still developing, or if the regulatory environment in your jurisdiction is overtly hostile to digital assets, creating unacceptable legal exposure.

Conclusion

Asset tokenization stands as a pivotal innovation at the intersection of finance and technology, promising to redefine ownership, liquidity, and accessibility for a wide array of assets. While it presents a new frontier with its own set of challenges, including regulatory ambiguity and technological risks, the potential benefits of fractionalized ownership, enhanced liquidity, and operational efficiency are too significant to ignore. The decision to tokenize an asset is a strategic one, demanding a careful evaluation of the asset’s characteristics, your financial objectives, and your risk tolerance. As the regulatory landscape matures and technology becomes more robust, asset tokenization is poised to move from a niche application to a mainstream financial instrument, offering a compelling answer for those seeking to modernize their portfolio and unlock the dormant value within their holdings.

💡 Click here for new business ideas

Leave a Reply