📚 Table of Contents

The world of finance is undergoing a seismic shift, powered not by Wall Street titans in glass towers, but by algorithms and neural networks running on servers that could be anywhere—including your home office. What if you could position yourself at the forefront of this revolution, turning the disruptive power of artificial intelligence into a viable and lucrative career, all without leaving your house? The opportunity to build a career in AI investing from home is not a distant future concept; it is a present-day reality for those with the foresight and dedication to seize it.

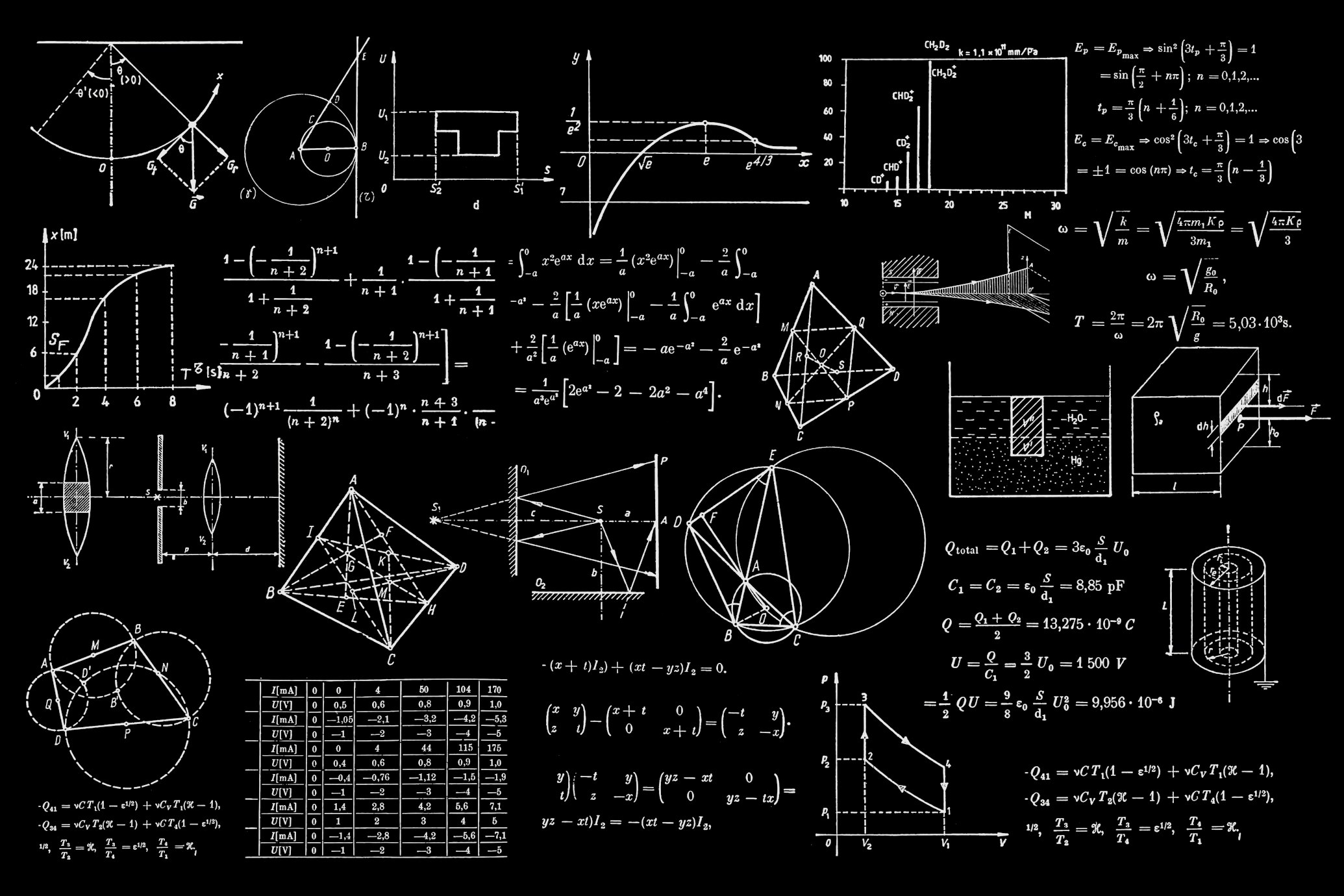

This path merges the analytical rigor of finance with the transformative potential of technology. It’s about more than just picking stocks; it’s about understanding how machine learning models can predict market trends, how natural language processing can analyze thousands of earnings reports in seconds, and how computer vision can interpret satellite images to forecast a company’s performance. This comprehensive guide will walk you through every step, from building the necessary knowledge base to executing sophisticated investment strategies from your personal computer.

Understanding the AI Investing Landscape

Before you place your first trade, it’s crucial to understand the terrain. AI investing is a broad field that encompasses several distinct approaches. The first is investing in AI companies. This involves identifying and capitalizing on businesses that are developing foundational AI technologies, such as semiconductor manufacturers like NVIDIA, cloud infrastructure providers like Amazon Web Services, and pure-play AI software firms. Your analysis here focuses on their technology’s competitive moat, patent portfolio, and potential for market adoption.

The second, more advanced approach is investing with AI. This is where you transition from a passive investor to an active AI-driven fund manager. This involves using artificial intelligence tools and models to inform your investment decisions. For instance, you might use a sentiment analysis algorithm to scrape news articles and social media to gauge public perception of a company. Alternatively, you could develop or utilize quantitative models that identify patterns in historical market data to predict future price movements. This method requires a deeper technical skillset but offers a significant competitive advantage.

Finally, there is the emerging field of AI-powered trading, which often falls under the umbrella of algorithmic or “algo” trading. Here, you create systems that can execute trades autonomously based on predefined criteria. A simple example is a bot that buys a stock when its 50-day moving average crosses above its 200-day average. A more complex system might use reinforcement learning, where an AI agent learns the optimal trading strategy through trial and error in a simulated market environment. Understanding these different facets is the first step in carving out your unique niche in the world of AI investing.

Essential Skills for the Modern AI Investor

Building a successful career in AI investing from home demands a hybrid skillset that bridges two complex domains. Let’s break down the non-negotiable competencies you’ll need to cultivate.

Financial Acumen: You cannot outsource your fundamental understanding of markets. This includes proficiency in financial statement analysis (reading balance sheets, income statements, and cash flow statements), valuation techniques (DCF models, comparable company analysis), and macroeconomic principles. You must understand what drives company value and how broader economic cycles impact different sectors, especially the volatile tech sector where many AI companies reside.

Technical and Data Proficiency: This is what separates the AI investor from the traditional one. You don’t need to be a PhD data scientist, but you must be comfortable with data. Key areas include:

– Programming: Python is the undisputed king in the AI and data science world. Libraries like Pandas for data manipulation, NumPy for numerical computing, Scikit-learn for machine learning, and TensorFlow or PyTorch for deep learning are essential tools. You’ll use these to clean data, build models, and backtest strategies.

– Data Analysis & Statistics: A strong grasp of statistics—concepts like regression, probability distributions, and statistical significance—is critical for evaluating the performance and reliability of your models.

– Understanding ML Models: You need to know the strengths and weaknesses of different algorithms. For example, knowing that a decision tree might overfit on noisy financial data, or that a time-series model like an LSTM (Long Short-Term Memory) network might be better suited for forecasting stock prices.

Market Research and Continuous Learning: The AI field evolves at a breakneck pace. A model or technology that is cutting-edge today could be obsolete in 18 months. You must develop a system for continuous learning, regularly reading research papers from conferences like NeurIPS, following key influencers in the AI and fintech space, and staying abreast of regulatory changes that could impact AI companies.

Building Your Educational Foundation from Home

The beautiful aspect of starting a career in AI investing today is that the best educational resources are available online, often for free or at a low cost. You can construct a world-class education from your living room.

Begin with structured online courses. Platforms like Coursera, edX, and Udacity offer “Specializations” and “Nanodegrees” specifically in AI and Machine Learning. For example, Andrew Ng’s “Machine Learning” course on Coursera is a legendary starting point. Simultaneously, bolster your finance knowledge with courses on corporate finance and investment from the same platforms or from established institutions like the CFA Institute, which offers introductory modules.

Next, move from theory to practice. Set up a coding environment on your computer using Jupyter Notebooks, which is ideal for data analysis and experimentation. Then, immerse yourself in the vast repositories of financial data available through free APIs. Yahoo Finance API (via the `yfinance` library in Python) is a fantastic starting point. Your first project could be as simple as writing a script that pulls the last five years of daily price data for a list of tech stocks, calculates their moving averages, and visualizes the results. This hands-on experience is invaluable.

Furthermore, engage with the community. Follow GitHub repositories dedicated to algorithmic trading. Participate in forums like Reddit’s r/algotrading or Stack Overflow. Join Kaggle competitions, some of which are finance-focused, to test your skills against real-world datasets and learn from other data scientists. This self-directed, project-based learning approach will build a far more robust foundation than passive consumption of video lectures alone.

Practical Steps to Start Investing in AI

With a foundation in place, it’s time to take actionable steps. The key is to start simple, document everything, and iterate based on results.

Step 1: Paper Trading with an AI Twist. Before risking real capital, open a paper trading account with a broker that offers a robust API (Application Programming Interface), such as Interactive Brokers or Alpaca. This allows you to simulate trades with virtual money. Your goal here is not just to pick stocks, but to test your AI-driven hypotheses. For instance, create a simple model that ranks S&P 500 stocks based on a combination of fundamental metrics (P/E ratio, debt-to-equity) and a sentiment score derived from recent news headlines. Use your paper trading account to simulate a portfolio based on this model’s top 10 picks. Meticulously track its performance against a benchmark like the S&P 500 index.

Step 2: Developing a Simple Quantitative Strategy. Move beyond simple stock picking to a rules-based system. A classic beginner strategy is a “mean reversion” model for a volatile ETF. Using Python, you can calculate the Bollinger Bands for an ETF like TQQQ. Your algorithm could be programmed to generate a “buy” signal when the price touches the lower band and a “sell” signal when it touches the upper band. Backtest this strategy on historical data to see how it would have performed. The goal is to understand the entire lifecycle of a quant strategy: data acquisition, signal generation, backtesting, and execution (even if simulated).

Step 3: Deploying Capital and Scaling Slowly. Once you have a strategy that shows consistent promise in paper trading and backtesting over a significant period (at least 6-12 months of simulated data), you can begin with a small amount of real capital. The psychology of trading with real money is different, so start small. Use a broker that supports API access so you can eventually automate your trades. As you gain confidence and your models prove robust, you can gradually scale your investment. Remember, risk management is paramount; never let a single algorithm or trade expose you to catastrophic loss.

Advanced Strategies for a Career in AI Investing

As you mature in your journey, you can explore more sophisticated avenues that can transform this from a side hobby into a full-fledged career.

One path is to develop and sell proprietary trading signals or algorithms. If you create a model that demonstrates consistent alpha (market-beating returns), you can monetize it by offering a subscription service to other traders through platforms like Collective2 or by building your own website. This requires a strong track record and transparent reporting of your strategy’s performance.

Another advanced route is to delve into alternative data. While most investors look at price and volume, you can use AI to analyze unconventional datasets. For example, you could use computer vision to analyze satellite images of retailer parking lots to estimate foot traffic before earnings reports. Or, use natural language processing to analyze the tone and complexity of a CEO’s speech on earnings calls to gauge confidence and potential future performance. Sourcing and modeling this data is complex but can provide a unique informational edge.

For the most ambitious, the ultimate goal might be to launch your own fund or manage capital for others. This typically requires a proven long-term track record, a solid legal structure (like an LLC), and compliance with financial regulations. While this is a significant undertaking, the rise of fintech and online brokerages has lowered the barriers to entry, making it a more feasible goal for a talented individual operating from a home office than ever before.

Conclusion

Forging a career in AI investing from home is a challenging yet profoundly rewarding endeavor. It is a marathon, not a sprint, requiring a commitment to lifelong learning in two of the most dynamic fields imaginable: finance and technology. The journey begins with building a solid dual foundation in market principles and data science, progresses through rigorous practical application with simulated trading, and can culminate in the management of sophisticated, automated investment systems. By methodically developing your skills, starting with small, calculated steps, and continuously adapting to the technological landscape, you can position yourself at the nexus of two powerful forces shaping our future, turning your home computer into a command center for the next generation of wealth creation.

💡 Click here for new business ideas

Leave a Reply