📚 Table of Contents

- ✅ Understanding NFTs: Beyond the Hype

- ✅ How NFTs Work: The Blockchain Backbone

- ✅ Digital Assets Explained: A Broader Universe

- ✅ NFTs vs. Digital Assets: The Key Distinctions

- ✅ Real-World Applications and Use Cases

- ✅ Creating and Buying NFTs: A Practical Guide

- ✅ The Future Potential and Challenges

- ✅ Conclusion

Understanding NFTs: Beyond the Hype

In a world increasingly dominated by the digital, a revolutionary concept has taken center stage, challenging our very understanding of ownership and value. What if you could possess a one-of-a-kind digital item, whose authenticity and provenance are guaranteed by an unbreakable, public ledger? This is the core promise of Non-Fungible Tokens, or NFTs. At its simplest, an NFT is a unique cryptographic token on a blockchain that represents ownership of a specific digital or physical asset. The term “non-fungible” is the key to understanding its power. Something fungible is interchangeable, like a dollar bill or a Bitcoin—one is worth exactly the same as another. A non-fungible item, however, is entirely unique and cannot be swapped on a one-to-one basis. Think of the Mona Lisa; you can make a million prints, but there is only one original. An NFT functions as the certificate of authenticity for that “original” in the digital realm.

This technology has exploded in popularity, with headlines often focusing on multi-million dollar sales of digital art. For instance, the artist Beeple sold a collage titled “Everydays: The First 5000 Days” for a staggering $69 million at Christie’s auction house. But to dismiss NFTs as merely expensive JPEGs is to miss the profound shift they represent. They are a new paradigm for digital scarcity and verifiable ownership. Before NFTs, digital files could be copied infinitely with no degradation in quality. If you bought a song on iTunes or a digital book on Amazon, you purchased a license to use it, but you did not own an asset that you could resell or use as collateral. NFTs change this dynamic by creating a transparent and immutable record of who owns what, opening up entirely new economic models for creators, collectors, and investors.

How NFTs Work: The Blockchain Backbone

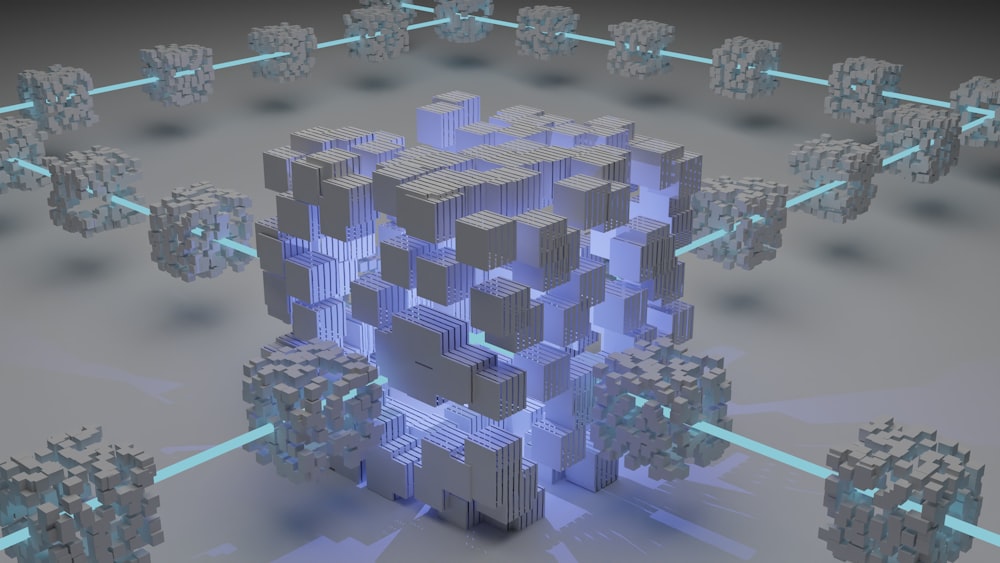

The entire ecosystem of NFTs is built upon the foundation of blockchain technology. A blockchain is a decentralized, distributed digital ledger that records transactions across many computers in such a way that the registered transactions cannot be altered retroactively. This provides the security and transparency that makes NFTs viable. When an NFT is “minted,” a smart contract—a self-executing contract with the terms of the agreement directly written into code—is deployed on a blockchain, most commonly Ethereum. This process creates a unique token with specific metadata. This metadata typically includes crucial information such as the token’s name, a link to the digital asset it represents (often stored on a decentralized storage system like IPFS), and properties that make it unique.

It is critical to understand that the NFT itself is not the image, video, or song. The NFT is the token on the blockchain that points to that file. When you purchase an NFT, you are buying this token, which acts as a deed of ownership. This ownership is then recorded on the blockchain for everyone to see. Every time the NFT is sold or transferred, the transaction is recorded, creating a public and verifiable chain of custody, or provenance. This provenance is a core part of an NFT’s value, as it authenticates the item’s history and legitimacy. The smart contract can also be programmed to include royalties, meaning the original creator can automatically receive a percentage of every future sale of the NFT, a feature that has the potential to revolutionize artist compensation.

Digital Assets Explained: A Broader Universe

While NFTs have captured the public imagination, they are actually a subset of a much larger and more established category known as digital assets. A digital asset is any text, media, or data that is formatted into a binary source and includes the right to use it. This is a broad term that encompasses everything you interact with online. Your social media posts, the documents in your cloud storage, the cryptocurrency in your digital wallet, the domain name of your website, and even your email list are all forms of digital assets. They hold value, whether personal, financial, or intellectual.

Digital assets can be divided into several key categories. First, there are cryptocurrencies like Bitcoin and Ethereum, which are fungible tokens used as a medium of exchange or a store of value. Second, there are utility tokens that provide access to a specific product or service within a blockchain ecosystem. Third, there are security tokens, which represent ownership of a real-world asset like company stock or real estate. Finally, there are the non-fungible tokens (NFTs) we’ve been discussing, which represent unique assets. The key takeaway is that the world of digital assets is vast and multifaceted, with NFTs representing just one, albeit highly innovative, application of blockchain technology to manage ownership and transfer of value.

NFTs vs. Digital Assets: The Key Distinctions

Understanding the relationship between NFTs and digital assets is crucial. The simplest way to frame it is that all NFTs are digital assets, but not all digital assets are NFTs. The primary distinction lies in the concepts of fungibility and provable ownership. A standard digital asset, like a JPEG file or an MP3, is easily replicable. You can right-click and save an image from the internet, and your copy is functionally identical to the original. There is no inherent, verifiable way to claim ownership of that specific file. An NFT, by contrast, introduces artificial scarcity and a mechanism for proving ownership through the blockchain.

For example, consider a popular digital collectible like a CryptoPunk. There are 10,000 uniquely generated characters. While anyone can screenshot a picture of a CryptoPunk, only one person can own the specific NFT that is cryptographically linked to that specific Punk on the Ethereum blockchain. The ownership is public, indisputable, and transferable. This is a fundamental shift from traditional digital assets. Furthermore, while a digital asset’s value is often tied to its utility or content, an NFT’s value is also heavily influenced by its provenance, the status of its creator, its rarity within a collection, and its historical significance within the crypto culture.

Real-World Applications and Use Cases

The potential applications for NFTs and blockchain-based digital assets extend far beyond digital art and collectibles. We are only beginning to scratch the surface of how this technology can transform various industries.

In the world of gaming, NFTs are revolutionizing the concept of in-game items. Instead of spending money on a sword or skin that is locked within a game developer’s platform and has no value outside of it, players can own these items as NFTs. This means they can truly own their digital possessions, trade them with other players on open marketplaces, and even use them across different compatible games, creating a player-driven economy.

The music industry is another fertile ground. Artists can mint NFTs representing albums, songs, or exclusive experiences like backstage passes. This allows them to connect directly with their fans and capture a larger share of the revenue, bypassing traditional intermediaries. Kings of Leon, for example, released their album as an NFT, which included special perks for holders.

Other exciting use cases include:

- Real Estate: Property deeds can be tokenized as NFTs, simplifying and securing the process of buying, selling, and transferring ownership.

- Identity and Credentials: Academic degrees, professional licenses, and even digital identities can be issued as NFTs, making them tamper-proof and easily verifiable.

- Supply Chain: Luxury goods and high-value items can be tracked with NFTs to verify their authenticity and origin, combating counterfeiting.

- Event Ticketing: Tickets for concerts and sports events can be minted as NFTs to eliminate fraud and scalping, while also providing collectors with a memorable digital souvenir.

Creating and Buying NFTs: A Practical Guide

For creators interested in minting their first NFT, the process has become increasingly user-friendly. The first step is to choose a blockchain. Ethereum is the most established, but alternatives like Solana, Polygon, and Flow offer lower transaction fees and are gaining popularity. Next, you need a crypto wallet, such as MetaMask or Phantom, to store your cryptocurrency (needed to pay for transaction “gas fees”) and your NFTs. Then, you connect your wallet to an NFT marketplace like OpenSea, Rarible, or Magic Eden. These platforms provide user-friendly interfaces to upload your digital file (art, music, etc.), add a description and properties, and mint the NFT. It’s during this minting process that you deploy the smart contract and create the unique token on the blockchain.

For buyers, the process is similar. You need a funded crypto wallet connected to a marketplace. You can then browse collections, place bids, or buy NFTs outright. It is essential for both creators and buyers to conduct thorough research. The space is still nascent and carries risks, including market volatility, potential copyright infringement (if someone mints art they don’t own), and smart contract vulnerabilities. Understanding the fees involved, from minting costs to marketplace commissions and royalty structures, is also critical before diving in.

The Future Potential and Challenges

The future of NFTs and digital assets is incredibly promising, yet it is not without significant challenges. On the one hand, the technology holds the potential to democratize ownership, empower creators, and create new, transparent digital economies. We are likely to see deeper integration with virtual and augmented reality, leading to a fully-realized “metaverse” where our digital possessions have tangible value and utility. The concept of “phygital” assets—NFTs tied to physical objects—could also become commonplace, blurring the lines between our physical and digital lives.

However, several hurdles must be overcome for mass adoption. Scalability and environmental concerns related to the energy consumption of some blockchains are major issues, though the industry is rapidly moving towards more energy-efficient consensus mechanisms like Proof-of-Stake. Regulatory uncertainty also looms large, as governments around the world grapple with how to classify and tax these new asset classes. Furthermore, improving the user experience to make it as simple as using a traditional web app is crucial for bringing in the next wave of users who are not crypto-native. Despite these challenges, the fundamental innovation that NFTs represent—verifiable digital ownership—is a powerful force that is likely to have a lasting impact on our digital future.

Conclusion

The emergence of NFTs has fundamentally reshaped our conversation around digital ownership and value. They are not a passing fad but a foundational technology that introduces scarcity, provenance, and new economic models to the digital world. While they exist within the broader universe of digital assets, their unique, non-fungible nature sets them apart, enabling applications from art and collectibles to gaming, music, and identity verification. As the technology matures and overcomes its current challenges, the line between our physical and digital possessions will continue to blur, opening up a world of unprecedented opportunity for creators, collectors, and innovators alike. Understanding NFTs and digital assets is no longer a niche interest but a crucial step in navigating the next evolution of the internet.

💡 Click here for new business ideas

Leave a Reply